Investment Strategy : Balanced

OBJECTIVES:

The Balanced Investment Strategy is specifically designed for clients who specify a Medium Risk mandate and who place an equal emphasis on achieving long term growth in their capital and income. The portfolio will typically hold no more than 20% to 35% in lower risk investments and no more than 15% in higher risk investments.

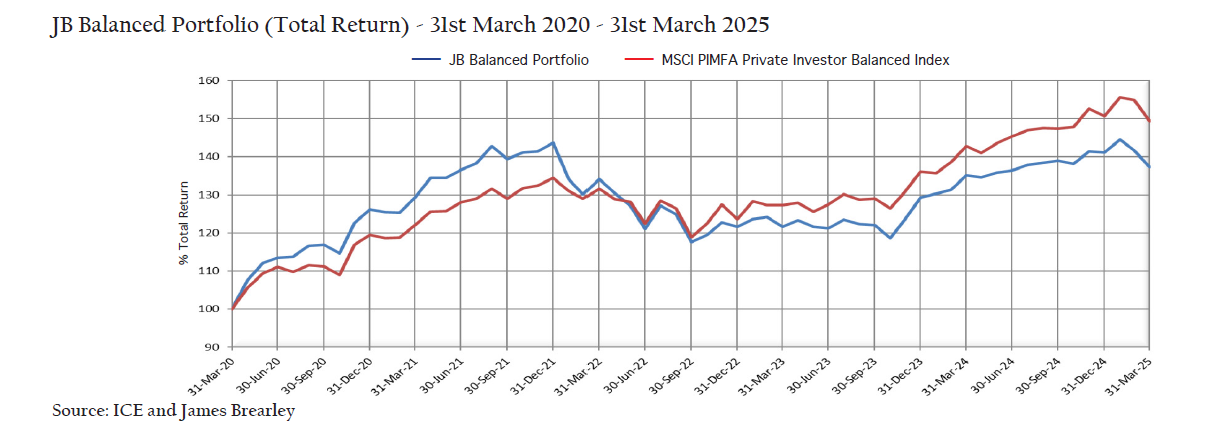

The portfolio is benchmarked against the MSCI PIMFA Private Investor Balanced Index

PERFORMANCE:

Cumulative Total Return Performance

| INDEX | 1y Total Return % |

3y Total Return % |

5y Total Return % |

10y Total Return % |

|---|---|---|---|---|

| JB Balanced Portfolio* | 1.59 | 2.41 | 37.30 | 69.05 |

| MSCI PIMFA Private Investor Balanced Index |

4.58 | 13.55 | 49.39 | 76.98 |

| Cboe UK All Companies Index | 7.65 | 29.49 | 37.66 | 68.74 |

| MSCI AC World Ex UK Index | 15.61 | 26.37 | 75.71 | 173.87 |

Discrete 1 Year Total Returns Performance

| INDEX | Mar 2025 Total Return % |

Mar 2024 Total Return % |

Mar 2023 Total Return % |

Mar 2022 Total Return % |

Mar 2021 Total Return % |

|---|---|---|---|---|---|

| JB Balanced Portfolio* | 1.59 | 11.09 | -9.26 | 3.72 | 29.27 |

| MSCI PIMFA Private Investor Balanced Index |

4.58 | 12.20 | -3.23 | 7.80 | 22.04 |

| Cboe UK All Companies Index | 7.65 | 8.41 | 3.78 | 13.21 | 26.60 |

| MSCI AC World Ex UK Index | 15.61 | 75.26 | -1.43 | 12.16 | 40.38 |

Source: FE Analytics and ICE. All performance figures shown are Total Return. As at 31st March 2025.

*Source: James Brearley

Total return performance has been calculated by adding in the projected income from the other positions being re-invested on a quarterly basis as part of a general re-balance exercise. Total return performance has been calculated up until December 2015 by assuming the receipt of a quarter of the projected income every 3 months with this being reinvested into two model positions at half yearly intervals.

Any performance information shown represents model portfolios which are periodically restructured and/or rebalanced. Although the model portfolios are representative of a client’s individual portfolio, the actual returns may vary from the model portfolio returns shown. In addition, model portfolio performance quoted does not take into consideration the cost of investing and /or management fees. The returns achieved by a client may be lower than the returns shown above. Although the model portfolios are representative of a client’s individual portfolio the asset allocation of and the investments held in a client’s individual portfolio may differ.

Asset Allocation Summary (31/03/2025) (%)

Overall Risk Summary (31/03/2025) (%)

CURRENT PORTFOLIO: TOP 10 LARGEST HOLDINGS

| Top 10 Largest Holdings | Weighting % |

|---|---|

| Vanguard Funds PLC S&P 500 UCITS ETF | 8 |

| Guinness Global Income | 6 |

| Man GLG Sterling Corporate Bond Professional | 5.5 |

| Atlantic House Defined Returns Fund -ACC | 5 |

| Royal London Global Bond Opportunities | 4.5 |

| First Trust SMID Rising Dividend Achievers UCITS ETF | 4.5 |

| Nomura Global Dynamic Bond | 4 |

| Artemis UK Select | 4 |

| Man GLG Equity Income | 4 |

| Fundsmith Equity | 4 |

| Total | 49.5 |

IMPORTANT INFORMATION

Investing in stockmarket based investments may not be right for all investors. You should consider carefully and/or seek professional guidance before investing. Please remember that past performance should not be seen as a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency movements and you may not get back the amount you originally invested.